Wells Fargo Private Bank stands at the intersection of bespoke financial services and elite wealth management, catering to discerning clients seeking tailored investment solutions. With a rich heritage and a commitment to excellence, it offers a suite of services designed to address the unique needs of high-net-worth individuals and families. This institution thrives on its ability to combine in-depth market knowledge with personalised relationship management, ensuring that every client feels valued and understood.

From comprehensive financial planning to sophisticated investment strategies, Wells Fargo Private Bank is dedicated to empowering clients on their wealth journeys. Emphasising both risk management and portfolio diversification, the bank offers an array of options that are meticulously crafted to align with the aspirations and risk tolerances of its clientele. As technology transforms the landscape of private banking, Wells Fargo remains at the forefront, adapting to emerging trends whilst maintaining its commitment to exceptional service.

Overview of Wells Fargo Private Bank

Wells Fargo Private Bank stands as a premier provider of wealth management services, tailored specifically to meet the complex financial needs of high-net-worth individuals, families, and institutions. With a rich legacy in financial services, Wells Fargo leverages its extensive resources and expertise to deliver personalised solutions that empower clients to achieve their financial aspirations.

The services offered by Wells Fargo Private Bank encompass a comprehensive suite of wealth management solutions, including investment management, financial planning, trust and fiduciary services, and private banking. Each service is designed to address the unique challenges faced by affluent clients, enabling them to effectively manage and grow their wealth across generations. Their investment management strategies employ a diverse array of asset classes, while financial planning services provide bespoke strategies for tax management, retirement planning, and philanthropic endeavors.

Target Clientele and Market Positioning

Wells Fargo Private Bank primarily serves high-net-worth individuals, families, and institutional clients who seek sophisticated financial solutions. This clientele often includes successful entrepreneurs, executives, and inheritors of substantial wealth, all of whom require tailored advice and strategies to preserve and enhance their financial legacies. By positioning itself as a trusted advisor, Wells Fargo aims to build long-term relationships founded on understanding and governance of its clients’ unique financial circumstances.

The market positioning of Wells Fargo Private Bank is bolstered by its established reputation and commitment to client service. The firm’s extensive network and resources allow it to provide clients with access to exclusive investment opportunities and financial products that may not be available to the average investor. This exclusivity enhances the value proposition of Wells Fargo Private Bank, making it an attractive choice for discerning clients seeking a holistic approach to wealth management.

Benefits of Using Wells Fargo Private Bank for Wealth Management

Engaging with Wells Fargo Private Bank offers numerous advantages for clients navigating the complexities of wealth management. The following points underscore the key benefits that clients can expect:

- Personalised Financial Solutions: Each client receives bespoke advice tailored to their individual financial goals and risk tolerance, ensuring that strategies are aligned with their specific needs.

- Comprehensive Wealth Management: The integration of investment management, estate planning, and banking services provides clients with a one-stop solution, streamlining their financial operations.

- Access to Expertise: Clients benefit from the insights of seasoned financial advisors and investment professionals, who provide guidance based on extensive market knowledge and experience.

- Tax Efficiency: The bank’s strategies are designed to minimise tax liabilities, enhancing overall investment returns and preserving wealth for future generations.

- Philanthropic Planning: Wells Fargo Private Bank assists clients in structuring their philanthropic activities, ensuring their charitable giving aligns with their values and maximises impact.

“The true measure of wealth is not just in the assets one possesses, but in the legacy one leaves behind.”

Through its comprehensive approach and commitment to client success, Wells Fargo Private Bank exemplifies an institution designed to cater to the evolving needs of affluent individuals and families in today’s complex financial landscape.

Investment Strategies

Wells Fargo Private Bank employs a sophisticated array of investment strategies designed to cater to the diverse financial needs of its clients. By leveraging in-depth market research and analysis, the bank aims to optimise portfolio performance while managing associated risks effectively. This strategic approach balances growth potential with risk mitigation, ensuring that clients’ investments are not only forged in the present but are resilient against future uncertainties.

One of the cornerstones of Wells Fargo’s investment strategy is its focus on customised asset allocation. Clients are provided with tailored portfolios that reflect their individual financial goals and risk tolerance. This bespoke service is complemented by a robust research framework, which influences investment decisions across various asset classes, including equities, fixed income, and alternative investments. The firm utilises a multi-disciplinary approach that integrates insights from its investment, wealth management, and risk management teams, ensuring a seamless alignment of objectives and strategies.

Risk Management Approaches

The risk management strategies employed by Wells Fargo Private Bank are comprehensive and multifaceted, designed to shield client portfolios from market volatility. The bank adopts both quantitative and qualitative methodologies to assess potential risks across different investment avenues. This rigorous framework distinguishes Wells Fargo from its competitors, who may not employ such an extensive risk analysis protocol.

Key features of Wells Fargo’s risk management approach include:

- Portfolio Stress Testing: Regular stress tests are conducted to evaluate how portfolios would perform under various adverse market conditions, allowing for timely adjustments.

- Diversification Techniques: The bank stresses the importance of diversifying investments across multiple asset sectors to mitigate risks associated with specific market downturns.

- Compliance and Regulatory Oversight: Wells Fargo maintains stringent compliance practices, ensuring that all investment activities align with regulatory requirements and fiduciary standards.

- Dynamic Rebalancing: The firm employs a dynamic rebalancing strategy that adjusts portfolios in response to changing market conditions, thereby optimising risk-adjusted returns.

This multifaceted risk management framework not only enhances client confidence but also positions Wells Fargo as a leader in proactive risk mitigation compared to its competitors, who may lean towards more static models.

Portfolio Diversification Options, Wells fargo private bank

Wells Fargo Private Bank offers a wide range of portfolio diversification options, which are pivotal in enhancing returns while simultaneously mitigating risks. The bank recognises that a well-diversified portfolio is essential in navigating fluctuating market conditions and achieving long-term financial objectives.

The available diversification options include:

- Equity Investments: Clients can gain exposure to domestic and international equity markets through individual stocks, index funds, and exchange-traded funds (ETFs), allowing participation in various sectors and geographies.

- Fixed Income Securities: A variety of fixed income options such as government bonds, municipal bonds, and corporate bonds are available, catering to clients seeking stable returns and lower volatility.

- Alternative Investments: Wells Fargo includes alternative asset classes such as private equity, hedge funds, and real estate, which provide opportunities for higher returns that are less correlated with traditional markets.

- Cash and Cash Equivalents: Maintaining liquidity through cash reserves and money market funds allows clients to seize investment opportunities as they arise without compromising their overall strategy.

By presenting these diverse investment vehicles, Wells Fargo Private Bank ensures that clients have access to a balanced portfolio that aligns with their financial aspirations, risk appetite, and long-term wealth management strategies.

Client Experience and Relationship Management: Wells Fargo Private Bank

The client experience at Wells Fargo Private Bank is designed to foster lasting relationships and ensure that each client feels valued and understood. This bespoke approach to wealth management not only caters to individual financial needs but also emphasises the importance of personal interactions and trust-building throughout the client journey.

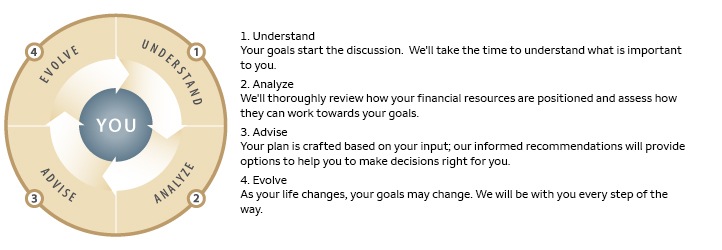

Onboarding Process for New Clients

The onboarding process for new clients at Wells Fargo Private Bank is meticulously structured to ensure a seamless transition into the bank’s services. This process typically involves several key steps that aim to establish a comprehensive understanding of the client’s financial goals and preferences.

- The initial meeting features a detailed discussion about the client’s financial aspirations, risk tolerance, and investment preferences.

- Following this, a personal relationship manager is assigned to the client, who will guide them through the onboarding process and serve as their primary point of contact.

- Clients’ financial information is collected securely, including documentation necessary for compliance and risk assessment.

- A tailored financial plan is then developed, aligning with the client’s objectives and taking into account their unique circumstances.

- Finally, clients are introduced to the relevant investment strategies and services that Wells Fargo Private Bank offers, paving the way for an effective financial partnership.

Personalised Services and Relationship Management Model

Wells Fargo Private Bank adopts a highly personalised approach to its services, ensuring that clients receive tailored solutions that meet their specific needs. The relationship management model is centred around proactive engagement and continuous dialogue, enhancing the overall client experience.

The relationship management framework includes:

- Regular portfolio reviews to assess performance and adjust strategies as needed.

- Access to a team of specialists, including financial planners, investment advisors, and estate planning experts, who collaborate to support the client’s diverse needs.

- Invitation to exclusive events, educational seminars, and networking opportunities, fostering community and engagement among clients.

- Client feedback mechanisms which allow for ongoing improvements to service delivery, thereby enhancing the overall relationship.

Illustrative Case Studies of Successful Client Relationships

Several testimonials highlight the positive impact of Wells Fargo Private Bank’s relationship management on clients’ financial journeys. One notable client, a successful entrepreneur, reported a transformative experience after onboarding with Wells Fargo. The tailored investment strategy developed not only preserved wealth but also significantly increased it over a five-year period, demonstrating the effectiveness of personalised service.

Another case involved a family seeking to establish a comprehensive estate plan. By collaborating closely with the family and utilising in-house specialists, the bank was able to design a strategy that not only met their immediate needs but also safeguarded their legacy for future generations, significantly enhancing their peace of mind.

These examples underscore the commitment of Wells Fargo Private Bank to nurturing strong client relationships, ensuring that each client’s unique vision is comprehensively addressed and effectively managed.

Future Trends in Private Banking

The landscape of private banking is undergoing a significant transformation, driven by shifting client expectations, technological advancements, and an evolving regulatory environment. As Wells Fargo Private Bank navigates these changes, understanding emerging trends will be paramount for sustaining competitive advantage and enhancing client service.

The influence of technology is rapidly reshaping the services offered within the private banking sector. Digital solutions are no longer merely supplementary; they are becoming foundational to client interactions and service delivery. Wells Fargo Private Bank is leveraging these technologies to provide personalised and efficient services that align with the needs of a tech-savvy clientele.

Technological Advancements in Private Banking

The impact of technology on private banking is multi-faceted, encompassing improvements in client engagement, service efficiency, and data analytics. The adoption of fintech solutions has enabled Wells Fargo Private Bank to refine its offerings significantly.

Key technological advancements include:

- Artificial Intelligence and Machine Learning: These technologies are being harnessed to analyse client behaviour and preferences, allowing for highly tailored financial solutions.

- Blockchain Technology: This offers enhanced security and transparency in transactions, which is vital for maintaining client trust in an increasingly digital world.

- Digital Platforms for Client Interaction: Enhanced user interfaces and mobile applications facilitate seamless communication and transaction capabilities, enriching the client experience.

- Data Analytics: Advanced analytics provide insights into market trends and portfolio performance, enabling proactive adjustments to investment strategies.

The integration of these technologies not only streamlines operations but also positions Wells Fargo Private Bank as a forward-thinking institution that prioritises innovation.

Challenges and Opportunities for Wells Fargo Private Bank

As the private banking sector evolves, Wells Fargo Private Bank faces both challenges and opportunities that will shape its future trajectory.

The primary challenges include:

- Increased Competition: Emerging fintech competitors are entering the private banking space, offering innovative solutions that attract clients away from traditional banks.

- Regulatory Compliance: Adapting to new regulations requires constant vigilance and flexibility, which can strain resources and impact service delivery.

Conversely, the opportunities are equally significant:

- Expanding Client Base: By embracing digital solutions, Wells Fargo can reach a younger demographic, tapping into a market that values convenience and accessibility.

- Enhanced Client Relationships: Personalised services facilitated by data analytics can foster deeper connections with clients, increasing loyalty and satisfaction.

- Innovative Product Development: Leveraging insights from technology can lead to the creation of new, bespoke financial products tailored to specific client needs.

In summary, while the future of private banking presents various challenges, the proactive adoption of technology and a focus on client-centric strategies will enable Wells Fargo Private Bank to thrive in an increasingly competitive environment.

In the realm of programming, a fundamental concept that often emerges is the phrase Hello world! , which signifies the initial steps taken by many eager coders. This simple expression serves as a rite of passage, marking the moment when one first interacts with a new programming language. It encapsulates the essence of learning and exploration in the digital landscape.

The phrase Hello world! has become a quintessential starting point for many programmers learning a new language. It encapsulates the essence of beginning a journey in coding, as it is often one of the first programs written. This simple yet profound statement signifies not only the initiation of a new skill but also the possibilities that lie ahead in the vast realm of technology.